Domestic and foreign economic environment is relatively stable, fabric production and sales are basically stable, the new cotton has entered the scale of the market period, but transportation and other issues are more prominent in the early stage. Estimated with the easing of the problems, coupled with next year's reserve cotton out of storage time has been clear, the actual supply of cotton and future supply is expected to ease, cotton prices or will enter the trend of retreat, need to be alert to external funding operations caused by commodity market fluctuations.

Bullish factors

1. cotton imports continue to decrease. According to the General Administration of Customs of China, China imported 41,000 tons of cotton in October 2016, down 19,000 tons from the previous month, a decrease of 31.8%; down 0.06 million tons year-on-year, a decrease of 1.5%. 2016 January-October China's cumulative imports of cotton 697,000 tons, down 505,000 tons year-on-year, a decrease of 42%.

2. Cotton production decreased year-on-year. National cotton market monitoring system in late October cotton production survey results show that the average yield of cotton in China in 2016 111.2 kg/mu, an increase of 9.2% year-on-year, down 0.8 percentage points from the August survey results; measured by China's actual cotton sowing area of 43.485 million mu, the estimated total output of 4.877 million tons, down 6.5% year-on-year, down 0.8 percentage points from the August forecast percentage point.

3. Foreign yarn imports continue to decline. According to new statistics from the General Administration of Customs of China, in October 2016, China imported 140,700 tons of cotton yarn, down 8.60% YoY and down 19.25% YoY; exported 26,000 tons of cotton yarn, down 12.54% YoY and up 17.27% YoY; net imports were 11.47 tons, down 7.65% YoY and down 24.57% YoY. From January to October 2016, China imported a total of 1,591,600 tons of cotton yarn, down 20.40% year-on-year; the cumulative export of 293,200 tons, up 1.46% year-on-year.

4. The inventory of raw materials of spinning enterprises has decreased, and the willingness to purchase has slightly increased. National cotton market monitoring system survey shows that, as of November 9, the average number of days of cotton stocks used by the sampled enterprises is about 31.1 days (including the number of imported cotton arrivals), a decrease of 5.7 days. Based on the relevant data, it is projected that the national cotton industrial inventory is about 646,000 tons, a decrease of 15.6% YoY and an increase of 2.8% YoY. Purchase intention survey shows that in early November 2016, enterprises intending to purchase raw materials accounted for 70%, an increase of 1 percentage point; enterprises not intending to purchase cotton accounted for 4%, a decrease of 2 percentage points.

5. Some domestic and foreign economic indicators have improved. U.S. real gross domestic product (GDP) grew at an annualized rate of 3.2% in the third quarter of this year, beating expectations and hitting a two-year high. Market participants believe the probability of a December interest rate hike is high. China's official manufacturing PMI for November was 51.7, up 0.5 percentage points from the previous month, in a continuous upward trend. Other data, such as consumption and industrial value added, also picked up in November.

Bearish factors

1. The scale of the new cotton market, transport bottlenecks to ease. As of November 25, the national progress of new cotton picking 96.1%, the national delivery rate of 86.5%, the national finishing rate of 79.4%, the national sales rate of 23.2%, down 4.2 percentage points, including Xinjiang sales rate of 21.2%. According to estimates, as of November 25, the national cumulative sales of seed cotton folded lint 4.057 million tons, the cumulative finishing lint 3.220 million tons, of which Xinjiang finishing lint 2.848 million tons; cumulative sales of lint 942,000 tons, a decrease of 243,000 tons, of which Xinjiang sales of lint 752,000 tons.

2. Reserve cotton rotation time in advance. Recently the progress of the Reform Commission, Ministry of Finance announced that "the new cotton listing period (currently to the end of February next year) does not arrange for the rotation of cotton reserves into the 2017 reserve cotton rotation sales will start from March 6, the deadline is tentatively set at the end of August, the daily number of listed sales temporarily arranged by 30,000 tons.

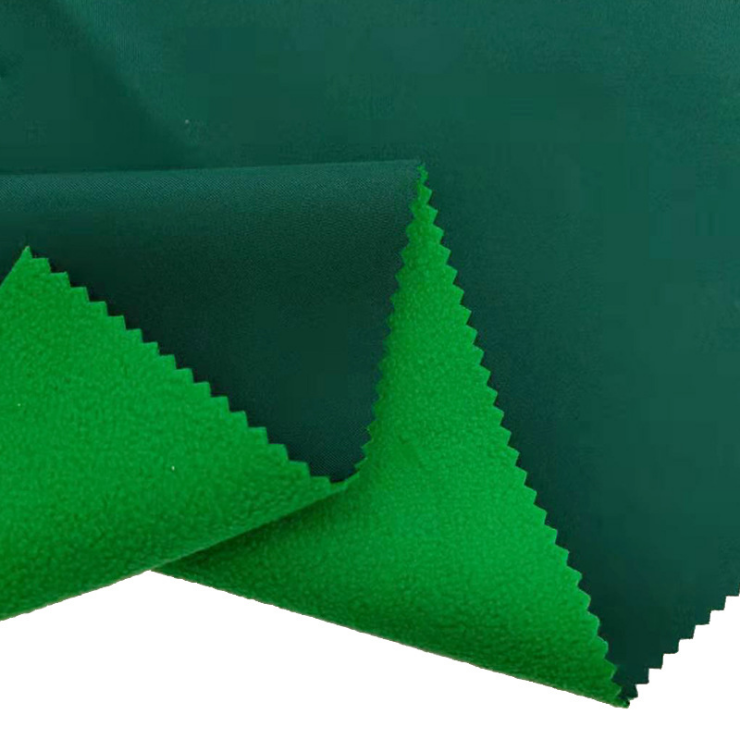

3. fabric products workwear exports continued to decline. in October 2016, China's fabric products workwear exports fell 5.73% ringgit, down 9.28% year-on-year, of which fabric products (including fabric spinning yarn, fabric and products) fell 6.64% year-on-year, workwear (including workwear and clothing accessories) fell 10.96%.

4. Yarn, cotton price difference narrowed. In recent months, domestic cotton prices rose more than yarn prices, spinning profit margin reduced. 30 November, domestic cotton prices rose 647 yuan / ton, or 4%, cotton combed 32 yarn prices rose 340 yuan / ton, or 1.4%, yarn and cotton spread narrowed 307 yuan / ton.

5. November, the RMB against the U.S. dollar exchange rate mid-price continued to rapidly lower, currently temporarily stable at 6.89. The slow depreciation of the RMB exchange rate is conducive to fabric exports, but rapid changes in the exchange rate has formed a disturbance to the operation of export enterprises.

Contact: Jeanne yang(MISS)

Phone: 13912652341

E-mail: [email protected]

Add: Room A2216/A2217,Double-Star Building,No 567 New South Middle Road, KunShan City JiangSu Province ,China.